Understanding Sustainability Reporting Frameworks: Essential Guide for Businesses

- Posted by admin

- On January 8, 2025

- 0 Comments

- Corporate sustainability strategy, ESG disclosures, Global Reporting Initiative (GRI), Sustainability reporting frameworks

Why Sustainability Reporting matters?

As stakeholders, regulators, and consumers increasingly demand sustainable practices, sustainability reporting has become essential to corporate transparency. Frameworks like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) help companies measure and disclose their environmental, social, and governance (ESG) impacts, making communication of these efforts clearer and more effective.

Globally, stock exchanges are strengthening their focus on ESG disclosures. Currently, 71 exchanges—over half worldwide—offer formal ESG guidance, up from just 13 in 2015. This growing trend highlights the rising importance of sustainability in capital markets. With mandatory ESG rules now in 27 markets, including 16 emerging economies, businesses are well-positioned to use these frameworks for compliance and long-term value creation. This shift, as noted by the UN’s Sustainable Stock Exchanges (SSE) Initiative, points to a future where ESG drives innovation and trust in the corporate world.

US and UK businesses are also aligning with both national and international sustainability standards, positioning themselves as leaders. By adopting these frameworks, they enhance stakeholder relationships and demonstrate a commitment to sustainable growth. Below is a table showing how US and UK stock exchanges align with sustainability reporting criteria:

Table 1- Alignment of US and UK Stock Exchanges with Sustainability Reporting Criteria

| Criteria | Nasdaq | New York Stock Exchange | London Stock Exchange |

| Has annual sustainability report | Yes | Yes | Yes

|

| Has written guidance on ESG reporting | Yes | Yes | No |

| Offers ESG related training | Yes | Yes | Yes |

| Market covered by sustainability-related index | Yes | Yes | Yes |

| Has sustainability bond listing segment | Yes | No | Yes |

Standard Setters of Sustainability Reporting Frameworks

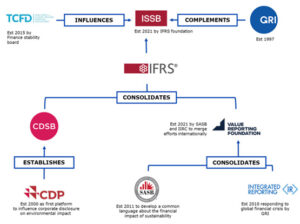

At COP26 in November 2021, a significant development occurred that reshaped corporate reporting when the International Financial Reporting Standards Foundation (IFRSF) announced the creation of the International Sustainability Standards Board (ISSB). This new body aims to establish a global baseline of high-quality sustainability disclosure standards to meet investors’ needs. The ISSB consolidates existing frameworks, including the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation (VRF), reducing fragmentation in sustainability reporting. In March 2022, the IFRSF and Global Reporting Initiative (GRI) formalized a collaboration to enhance the interoperability of their standards. The ISSB’s first two standards, IFRS S1 and IFRS S2, were proposed to provide general sustainability disclosure requirements and climate-related financial information, respectively. This marks a key step toward harmonizing sustainability standards globally.

Infographic 1- Global Reporting Standards

In the US & UK, businesses commonly refer to a few key frameworks:

- Global Reporting Initiative (GRI): The Global Reporting Initiative (GRI) is a widely adopted framework for sustainability reporting, applicable to businesses across industries. It covers a broad range of ESG topics like environmental impact, human rights, and anti-corruption, allowing companies to standardize their sustainability disclosures. GRI is flexible and can be used voluntarily or combined with other mandatory frameworks, helping US and UK businesses meet international and local sustainability expectations.

- Sustainability Accounting Standards Board (SASB): SASB provides industry-specific standards focused on financially material sustainability issues. Unlike GRI, which covers a wide array of ESG topics, SASB zeroes in on financial impacts. US companies prefer SASB for its alignment with domestic regulations, while UK companies with US operations or investor interest also benefit from its materiality-based approach.

- Task Force on Climate-related Financial Disclosures (TCFD): TCFD helps companies disclose climate-related financial risks by focusing on governance, strategy, risk management, and metrics. It is gaining prominence in the UK with mandatory climate disclosures by 2025 and is becoming increasingly relevant in the US as the SEC moves toward similar mandates. It benefits both US and UK companies, especially in carbon-intensive sectors.

- Corporate Sustainability Reporting Directive (CSRD)- UK Context: The CSRD significantly changes sustainability disclosure in the UK and EU by requiring audited, standardized ESG information. It applies to a broad scope of companies, including large UK firms with EU operations, and emphasizes verifiable sustainability data aligned with international standards.

- Climate Disclosure Standards Board (CDSB): CDSB helps integrate environmental information into mainstream financial reports, aligning with IFRS and US GAAP. It is widely used in both the US and UK markets, often alongside TCFD, to enhance the credibility and standardization of climate-related disclosures.

- Integrating Sustainability Reporting into Business StrategyEmbedding sustainability reporting into a company’s broader business strategy is critical to deriving long-term value from ESG initiatives. Rather than treating sustainability reporting as a mere compliance exercise, companies should view it as a strategic tool that drives better decision-making, strengthens risk management, and deepens stakeholder engagement. When integrated effectively, sustainability reporting can unlock numerous benefits, including enhanced corporate reputation, investor confidence, and operational efficiencies.Here are key steps businesses can take to successfully integrate sustainability reporting into their corporate strategies:

- Identify Material ESG Issues: Businesses should leverage frameworks like the SASB to identify ESG issues that are most financially material to their industry. These issues are often specific to each sector and focusing on them ensures that the company’s sustainability initiatives are aligned with investor expectations and market realities. For instance, a manufacturing company may prioritize carbon emissions reduction, while a tech company may focus on data privacy and energy efficiency.

- Set Clear Goals and Metrics: Establishing measurable sustainability goals is essential for tracking progress. Companies can use frameworks such as the GRI and the TCFD to set standardized metrics. For example, a business might aim to reduce carbon emissions by 20% over five years or increase workplace diversity. By setting clear, measurable goals, businesses can demonstrate their commitment to sustainability and track performance effectively.

- Engage Stakeholders: Engaging a broad range of stakeholders, including investors, employees, customers, and regulators, is crucial for the success of sustainability initiatives. Reporting frameworks encourage open communication, fostering transparency and trust. Regular updates on ESG efforts show stakeholders that a company is serious about its sustainability commitments, thereby enhancing its reputation and customer loyalty.

- Ensure Data Accuracy and Reliability: As sustainability reporting becomes more closely integrated with financial disclosures, the accuracy and reliability of ESG data are paramount. Businesses must ensure that their sustainability data is auditable and aligns with new regulatory requirements like the CSRD in Europe or the US SEC’s proposed climate disclosure rules. Partnering with external auditors or consultants to verify data can help maintain credibility and reduce risks of inaccuracies.

The Future of Sustainability Reporting

The landscape of sustainability reporting is rapidly evolving, with increasing regulatory scrutiny and stakeholder demand for transparent ESG data. As governments in both US & UK regions continue to tighten regulations around sustainability, businesses must be prepared to adopt more rigorous reporting frameworks.

Furthermore, the rise of sustainable finance, driven by initiatives like the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR), will push companies to disclose more detailed ESG data. Investors will increasingly expect businesses to demonstrate how they are managing ESG risks and opportunities in their financial and operational strategies.

The integration of sustainability into mainstream business practices will no longer be optional. Companies that proactively adopt and adapt to these frameworks will not only ensure regulatory compliance but also position themselves as leaders in the global movement toward sustainable development.

Conclusion

For businesses, understanding and implementing sustainability reporting frameworks is essential for meeting regulatory demands and staying competitive in a rapidly evolving marketplace. By leveraging frameworks such as GRI, SASB, TCFD, CSRD, and CDSB, companies can provide transparent, reliable, and actionable ESG disclosures that enhance their sustainability performance and build long-term value for stakeholders. As sustainability becomes increasingly intertwined with business success, adopting these frameworks is not just a compliance requirement but a strategic necessity.

0 Comments